The decade we have just lived through is the first in which the US, the world’s number one economy, has not experienced a recession1 . OK, so it was dominated by the long and slow recovery from the global financial crisis and propped up by central bank assistance in the form of QE, but there was no recession.

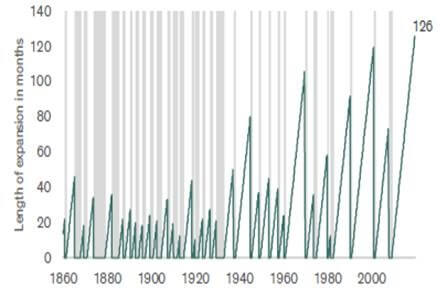

I think this chart from Bernstein is fascinating:

Source: Bernstein/Goldman Sachs, December 2019

As can be seen, over the past century or so economic cycles are clearly becoming longer. This reflects the changing nature of the economy over that time, from a largely agricultural-based one, through the industrial revolution and on to a consumer/service-driven one. Over the past decade we have had three industrial slowdowns around the euro crisis, the 2014 oil price collapse and the current trade-induced swoon exacerbated by the coronavirus. All have produced economic slowdowns, but none of these events has triggered a recession (yet, in the case of coronavirus).

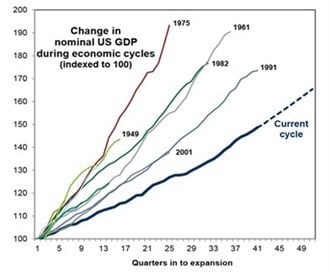

This is the longest economic expansion on record, even if it can be characterised as sub-par – as this chart shows:

And it triggers the question: are we due a recession? It is possible, but as we don’t see major imbalances in the economy, and the consumer is healthy, any recession, should one occur, is likely to be mild. In fact, our Fixed Income team is not forecasting one.

The other takeaway from the chart is that growth is slowing cycle by cycle – the reasons for which are many and varied, but it is a fact.

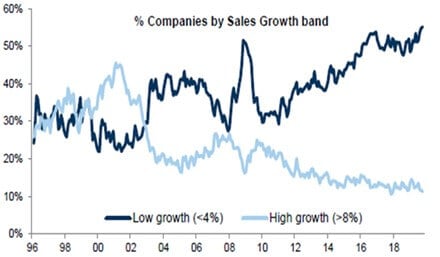

As investors today there are two challenges, both of which involve finding increasingly scare creatures. The first is yield, which I will leave to one side, though I commend you to look at the Threadneedle Global Equity Income Fund as a potential solution. The second is finding companies that can actually compound growth. As you can see in the next chart the proportion of companies that can deliver revenue growth in excess of 4% is declining, while the proportion of slow/no growth companies is increasing.

Few companies have high projected sales growth

Source: Goldman Sachs 2020

Finding quality growth companies capable of compounding in this low growth economic environment is our task on the Global desk. Our success in this has rewarded our clients relative to the market over the years, and we believe it will continue to do so in the 2020s. Please read some of the other World in Motion blog posts to see how and where we find these competitively advantaged companies that we believe can compound. And, and if you want to join us in this mission we/your friendly Columbia Threadneedle sales person would love to hear from you.