Our Capabilities

Multi-asset

Diverse opportunities drive consistency

Different asset classes respond differently to changes in the economic and business cycle, hence the investment returns from individual asset classes can vary significantly over time and differ markedly from those of other asset classes. By investing in a mix of assets and actively reviewing and changing our portfolios, in order to participate in investment opportunities while minimising volatility, we aim to deliver a smoother investment experience for investors.

- Potential to receive attractive levels of growth and/or income with less volatility than equities.

- Active allocation of risk, when managed efficiently, can provide investors with more return per unit of risk

- Uncorrelated sources of return can deliver important diversification benefits compared to single asset class portfolios

- Provides investors with an effective, ‘one stop shop’ investment solution.

On your bike - Shimano and cycling

Equity outlook: High valuations and higher-for-longer rates

Water in crisis – searching for solutions

Positives for Europe, but the Middle East could be a headache

In search of sustainability – following Highway 101

The Good, the Bad and the UK Stock Market

Why Columbia Threadneedle Investments for Multi-Asset?

Multi-asset investing is at the heart of what we do at Columbia Threadneedle Investments.

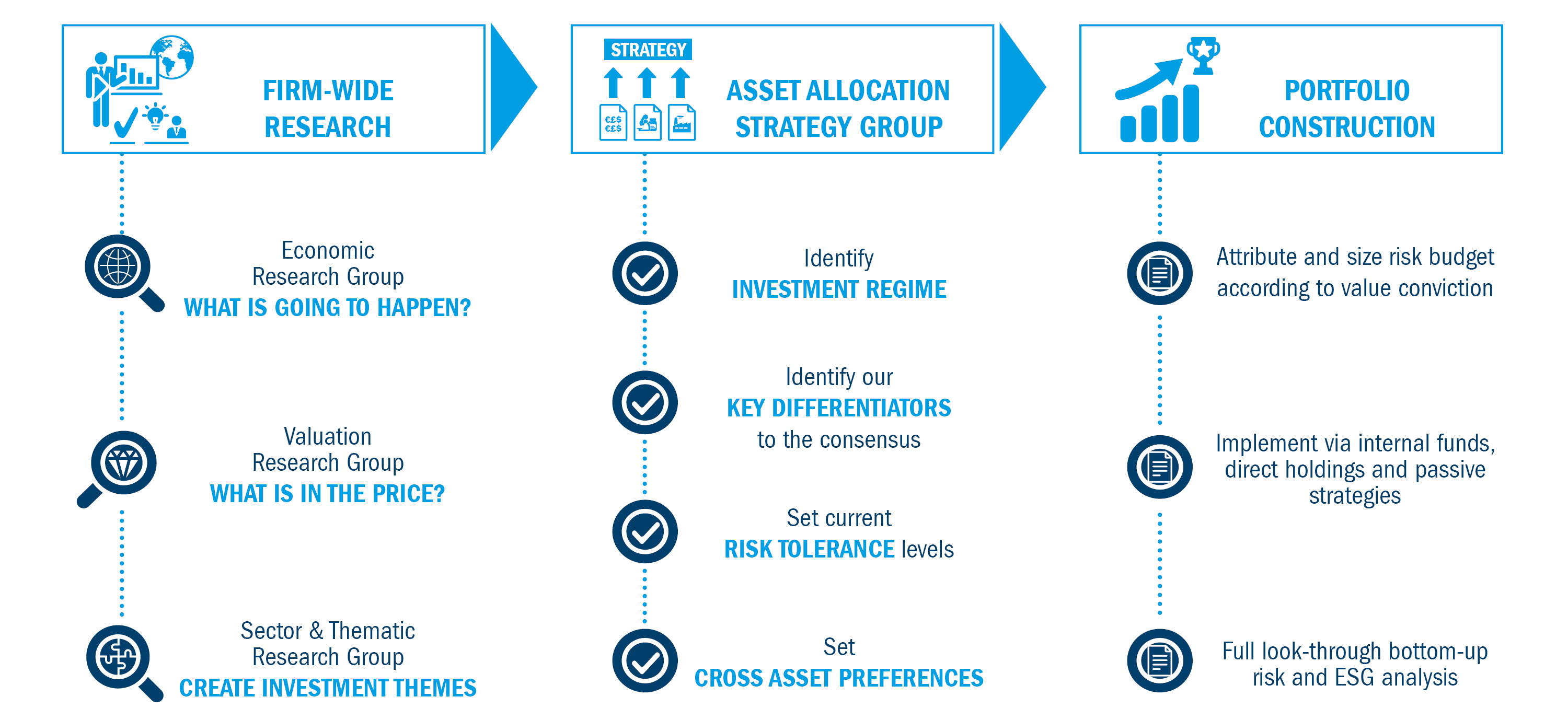

Our investment experts manage all multi-asset strategies using the same tried and tested process.

You may also like

About Us

Our Funds

Our Capabilities

We offer a broad range of actively managed investment strategies and solutions covering global, regional and domestic markets and asset classes.