- The steady recovery of the asset class since Q2 has been every bit as remarkable as the initial blow-out in spreads back in March. Much of the higher-rated EM universe now trades at spreads over US Treasuries roughly equivalent to those prevailing at the start of the year.

- With valuations in EM sovereigns around long-run averages – and with balance sheet risks now more pronounced – we are cautious about the potential for significant further spread tightening in hard-currency fixed income. But total return opportunities in the year ahead remain attractive, especially when accompanied by judicious credit selection.

- A steady global growth recovery supported by more constructive and multilateral US trade policy may just create ideal conditions for EM currencies to correct some of their underperformance against the US dollar.

- The semi-mature state of EMD markets creates good alpha opportunities across sovereigns and corporates in both hard and local currencies.

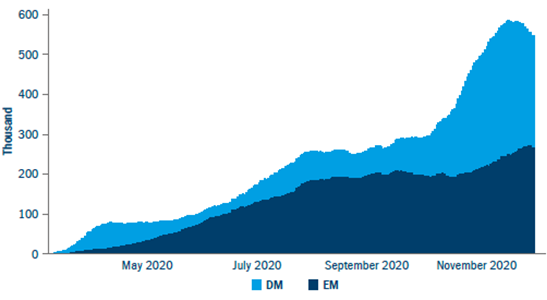

The legacy of Covid-19 in emerging markets (EMs) may take some time to become clear. Having lagged advanced economies’ initial surge in cases in March and April, lower income countries experienced highly concerning case growth at the end of the summer, before once again being eclipsed by the developed markets’ second wave (Figure 1).

The structural tightening of spreads in the early years of the 21st century have given way to a much more cyclical market; the EM credit asset class displays a strong correlation with developed market corporate credit and is well positioned for even a modest global growth recovery in 2021. Moreover, the global rate environment remains conducive to EMD performance with inflation benign, central banks expected to maintain accommodation and the stock of negative-yielding assets at around $15 trillion.1 Meanwhile, allocations to the asset class among international investors are still low, suggesting persistent inflows in coming years.

Figure 1: New Covid-19 cases, 7-day moving average

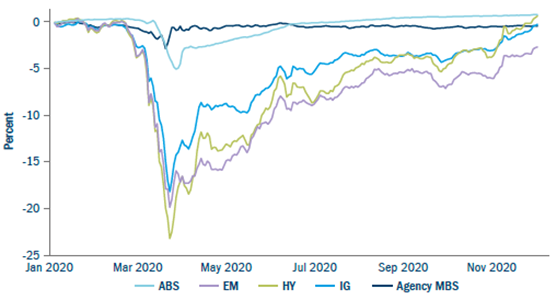

Figure 2: YTD excess returns by sector