After a long night of election news, we still do not know the results of the 2020 election, with the unprecedented healthcare backdrop creating unusual circumstances in counting votes. Should investors be alarmed?

“While this isn’t ideal, it’s not unprecedented,” says Columbia Threadneedle CIO, Colin Moore. “It is not unusual to not have all votes counted on election eve, but this year is especially challenging because of the large number of mail-in and absentee ballots. The difference in voting preference between mail-in/absentee (leaning Democrat) and in-person (leaning Republican) is quite dramatic and complicates predicting the outcome in a few states regardless of current tallies. So, in the short term we need to be patient while the counting process continues. However, if we end in a stalemate, we have constitutional backstops that address inconclusive results.” Indeed, Federal law requires that we have a president on Inauguration Day, which should give investors some degree of comfort in what is likely to be a volatile period.

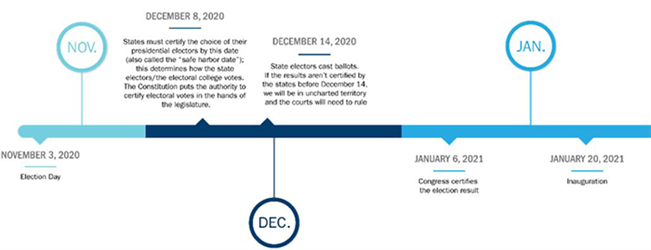

For now, state election boards are continuing to count votes (Figure 1). By 8 December the states must certify how they will vote in the electoral college, and on 14 December state electors will cast their electoral college ballots.

Nevertheless, a spike in volatility would not be surprising, particularly as investors analyse strident rhetoric, the timeline for resolution and the impact of judicial challenges along the way. “It is important to distinguish between challenges to vote counts generally and an outright refusal to hand over power or accept defeat,” says Moore. “If it turns out that Joe Biden has won the vote, we believe the Republican leadership understands that the reputation of the US would be irreparably damaged if there was not an orderly and peaceful presidential transition.”

Beyond the presidential race, the outcome in the Senate is also important for both candidates in terms of being able to implement their agendas. Several Senate races remain undecided, but the Republicans appear to have retained some of the most keenly contested seats. While not yet certain, it appears there is a greater possibility of split control of Congress regardless of the outcome of the presidential race. However, the role of the eventual vice president in tied Senate votes will be very important.

The US has seen divided government frequently, which has had the impact of limiting some of the more extreme proposals for change over that time. For some this check on power is the preferable outcome, but given the need for additional fiscal measures to address the economic damage caused by the ongoing pandemic, an ability to work together in the coming months is essential. “Mitigating the impact of Covid-19 is much more significant for the US and global economy than the outcome of the US election,” says Moore.

Summary

So, what should investors do in this period of electoral uncertainty? Stay focused on long-term goals and avoid emotional decisions. In the long run, changes in presidential administrations rarely lead to material fundamental changes in how the US economy works, especially if Congress is divided. Consequently, the basic economic tenets upon which the financial markets rely are unlikely to change. Staying focused on long-term goals remains the best course of action.