After a tough year for dividends in 2020, the outlook for 2021 is positive. Many of the sectors that were most impacted in 2020, such as autos, should see a good rebound in dividends. But this is not universal, with industries such as entertainment and aerospace likely to struggle throughout 2021. Focusing on sustainable dividends and capital return in this environment is even more vital than usual. However, the mix of capital return will require close attention too as companies and regulators consider the flexibility of share repurchases and special dividends.

Good riddance to 2020!

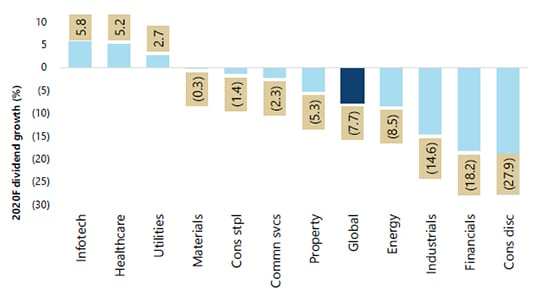

2020 was an extremely tough year for dividends, which declined by almost 8% (Figure 1a). The pandemic had a clear impact on GDP and economic activity due to the lockdowns seen across the globe. At the same time, the resulting rise in working from home was an acceleration of already existing technology adoption trends. This had a negative impact on cash flows of economically sensitive and working capital-heavy industries such as energy, aerospace and entertainment. If a company’s cash flow dries up, this brings the dividend into question and accordingly these sectors saw the biggest dividend declines in 2020, with the consumer discretionary sector experiencing dividends falling almost 30% (Figure 1a).

While there were also many management teams in less impacted industries that suspended dividends due to prudence or to guard their reputation (having used taxpayer schemes to pay employees), the banking and insurance industries were restricted from paying dividends by their regulators in many geographies. Consequently, the financial sector saw dividends fall almost 20% in 2020 (Figure 1a).

Figure 1a: MSCI ACWI forecast dividend growth by sector – 2020

Source: Jefferies & FactSet, January 2021. Note: Bottom-up aggregated with free float adjustment based on current MSCI universe.

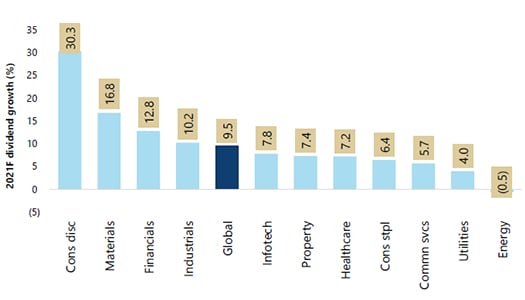

Figure 1b: MSCI ACWI forecast dividend growth by sector – 2021

Source: Jefferies & FactSet, January 2021. Note: Bottom-up aggregated with free float adjustment based on current MSCI universe.

A warm welcome to 2021!

The outlook for dividends globally is positive in 2021 – they are expected to rise 10% despite the continuing pandemic. Indeed, those sectors that were most impacted in 2020 are seeing a good rebound in 2021, though the materials sector is also likely to see strong dividend growth of more than 15% driven by buoyant commodity prices. We note that banks and insurers are likely to see dividends resume later this year, but this may be slower than investors would like with the regulator waiting until we are out of the woods (Figure 1b).

Of those companies that decided not to pay dividends in 2020 because of economic prudence or reputational issues, many have returned to dividend pay outs (sometimes accompanied by special dividends) and we expect this to continue. However, we believe those companies that could not pay dividends in 2020 due to their cash flow being impacted and operating in industries that are still struggling, such as entertainment and aerospace, will also not pay dividends in 2021. However, those that cut dividends but are operating in industries that are recovering, such as energy and autos, should see dividends start to recover or at least the dividend should become better covered by cashflow.

Two key dividend learnings from the pandemic

First and foremost, a focus on sustainable dividends is vital in income investing and this becomes even clearer in times of crisis. Companies operating in industries facing structural challenges or in cyclical sectors with highly leveraged balance sheets have been exposed. This has only reinforced our preference to invest in companies that offer sustainable income and growth, as we believe this is the best approach for total return through the cycle. Indeed, this pandemic will likely make genuine dividend sustainability even more greatly prized in this disrupted world. On top of this, our global opportunity set and portfolio construction approach of balanced exposure to different sources of dividends and sectors support a stable income profile across market cycles.

Secondly, and more nuanced, is that the pandemic is likely to change the mix of capital return in the coming years. Many companies have taken the opportunity to rebase their dividends and better recognise the flexibility that share repurchases and special dividends provide. This also looks true of the EU banking and insurance regulators, who have seen the greater flexibility that their counterparts in the US have enjoyed by being able to halt share buybacks, which is more impactful given lower dividend pay-out ratios in this market.

While this is a positive set up for increased dividends and capital return more generally as we head into 2021, it is important to consider the mix of that capital return, and this may be an enduring feature of the pandemic.