Transport assets remind us that, within ESG investing, ‘S’ can be just as important as ‘E’ and ‘G’, and focussing on the environment and governance at the expense of social aspects can be detrimental

When considering environmental, social and governance (ESG) investments, social attributes are often overlooked for the more salient environmental and governance characteristics. One reason for this stems from such aspects of a company being easier to assess, ie it is relatively easy to measure carbon emissions from aircraft or board diversity.

Social, however, is a bit more challenging. For example, building more homes to cater for expanding populations is an essential driver of economic growth. However, we need to understand the affordability level of the houses being built and how they ameliorate the standards of living for those in deprived locations – i.e. their social impact.

However, we may be entering a period where social investing is no longer treated as the poor relation.

Such behaviour is pervasive in relation to the evaluation of transport assets, where greenhouse gas (GHG) emissions in industries such as aviation and maritime transport overshadow their benefits to society. But both industries produce significant social impact and, in a period where investors are becoming increasingly alert to social characteristics, here we will outline the social benefits of shipping in addition to highlighting the encouraging developments on the environmental side. What emerges is an industry that offers appealing investments from a sustainability perspective which are not necessarily obvious on first inspection.

A global and social industry

Shipping is an integral part of the global economy. It was one of the first globalising forces and remains a key driver of global economic growth: responsible for approximately 90% of global trade, it generates more than €400 billion per annum and provides 13.5 million jobs globally1. In Europe it generates €140 billion and provides 2.1 million direct and indirect jobs2 (Figure 1).

Figure 1: Global attributes of the shipping industry

Source: Organisation for Economic Co-operation and Development, The Economic Value of Shipping and Maritime Activity in Europe, December 2016 / International Shipping Council: Valuation of Liner Shipping Industry report, 2009 / International Maritime Organisation 2018

The suitability of including the maritime sector within a responsible investment approach, however, is often questioned. But we believe it is inherently social: connecting communities and providing access to food, healthcare and education are the essential building blocks for a well-functioning society, and this is what the shipping industry delivers.

Away from major cities and economies, maritime transport enables social inclusion, particularly for the inhabitants of islands, and in such instances their social value is immeasurable. This has become even more salient during the Covid-19 pandemic, with the industry providing a lifeline service in terms of the delivery of food and medical supplies.

So, while such social attributes have been somewhat crowded out by environmental considerations, they have not gone unnoticed by the United Nations. Specifically, the UN Sustainable Development Goals (SDGs) highlight that the industry is a “critical enabler of food, energy, trade and tourism” within SDG 11: Sustainable Cities and Communities.

CalMac Ferries, for example, provides a freight and passenger service from the west coast of Scotland to the surrounding islands. It delivers the majority of items sold by local retailers, as well as fuel, food, mail medical supplies, oil, gas and utilities. Without these things it would be difficult to maintain an acceptable quality of life on the islands. These operations bring wider benefits to the local economy, the local labour market and island tourism. The economic impact for these activities is estimated by the University of Strathclyde to be £270 million3.

Connecting island communities to the mainland and ensuring their social and economic health was a primary driver behind our European Sustainable Infrastructure team’s acquisition of Condor Ferries earlier this year4. Condor Ferries acts as the primary facilitator of freight and passengers between the Channel Islands, the UK and France, delivering essential daily freight to the islands. Thus, the investment rationale for Condor is as an enabler of sustainable social and economic development for the Channel Islands through the provision of vital goods and services. Furthermore, it provides an essential lifeline service with regular crossings needed for just-in-time delivery given limited and reducing warehousing capacity on the Channel Islands.

The environmental perspective

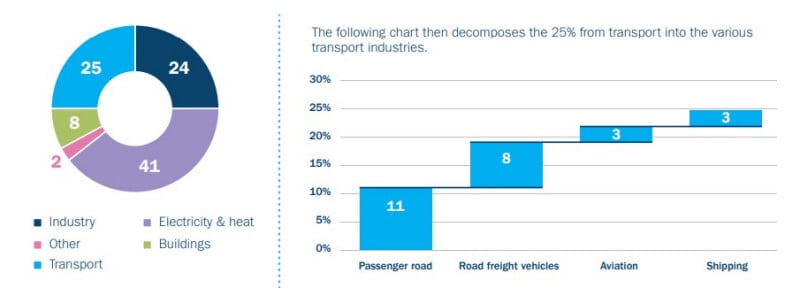

The most commonly cited critique of shipping is the emissions profile. The industry accounts for 2.4% of global GHG emissions, emitting around 940 million tonnes of CO2 annually5. But shipping has traditionally been one of the least carbon-intensive forms of transportation, alongside rail; it is, for example, much more carbon-efficient than road or air transport (Figure 2). However, the sheer volume of goods transported by sea means the overall contribution to global emissions is large – and growing. This is the challenge. The International Maritime Organisation (IMO) forecasts that shipping emissions could, under a business-as-usual scenario, increase between 50% and 250% by 2050, thus undermining the objectives of the Paris Agreement6. The industry, though, is responding.

Figure 2: GHG emissions by sector and transport industry (%)

Source: IEA & Société Générale, March 2020

IMO 2020 - the first wave

In line with the Paris Agreement the IMO agreed to several measures to curb GHG emissions under the IMO 2020 banner. These include:

- Aiming to reduce total annual GHG emissions from shipping by at least 50% by 2050 compared to 2008 levels

- Pursuing efforts to phase out maritime GHG emissions entirely as soon as possible in this century.

In keeping with these objectives, at the beginning of 2020 all ships had to operate on significantly reduced sulphur emission parameters (from a maximum of 3.5% sulphur to 0.5%7). This is an important step for the industry to start reducing its emissions profile. However, further improvement is required for the industry to meet the IMO’s 2050 targets, and to do so will require widespread adoption of clean fuel technologies.

An important consideration in the acquisition of Condor Ferries was the opportunity to develop the environmental outcomes of the business, specifically energy and waste efficiencies across the fleet and onshore as identified through our ESG analysis. While the current fleet is compliant with the IMO sulphur restrictions, we will seek to evolve the ships over time to cleaner propulsion technologies. This is likely to occur over the next decade as current propulsion technology for vessels is in a period of flux. There are lots of competing technologies – for example hydrogen, electric, methanol, liquified natural gas etc – and this is one of the compelling aspects within the sector (Figure 3). There is significant potential within the industry to not only deliver social impacts, but also participate in a fuel transition story that will generate material savings in GHG emissions over the next 20-30 years.

Figure 3: Competing technologies for clean propulsion fuel

Solution | Pros | Cons |

|---|---|---|

Low sulphur | Easy to adopt, fuel-efficiency improving with new technologies, slow steaming can reduce carbon | High GHG; some concerns around 2020 availability of low sulphur fuel oil (LSFO) |

Liquefied natural gas (LNG) | Safe, proven, evolving bunkering network, very low nitrogen oxide (NOx), sulphur dioxide (SOx), particulate matter (PM) more than 20% less than carbon dioxide, LNG carriers can use waste boil off-gas | Bunkering network investment still needed, future LNG pricing uncertain, methane slip, high capex (especially retrofit), potential loss of cargo capacity |

LPG | Low NOx, SOx, PM and lower CO2. LPG carriers can use cargo as fuel, extensive terminal infrastructure | Limited uptake as marine fuel to-date, economic incentive depends on pricing. Less CO2 reduction than LNG |

Methanol | Fuel handling and risk management simpler than LNG, reduced NOx, SOx and CO2, extensive existing terminal infrastructure | Retrofit can be complex and costly, fuel is toxic and corrosive, takes up twice as much space as marine diesel oil (MDO) |

Hydrogen | Potentially both clean and abundant, zero carbon emissions, attracting significant tech investment | Fuel production expensive, energy intensive and dependant on fossil fuels, very limited bunkering infrastructure |

Biofuels | Easily sourced, carbon-free, more established transportation network than hydrogen, has high hydrogen density when used in fuel cell | Combustion process inefficient due to low flammability, toxic substance production uses lots of power and releases CO2 |

Ammonia | Some types of biodiesel already widely available at competitive prices. Requires limited changes to engines and fuel handling | First generation relied on land use (driving deforestation), combustion releases CO2, problems surround availability of newer fuels |

Synthetic methane | Requires limited changes to engines/fuel handling (could use existing LNG infrastructure), good method of integrating carbon capture and storage systems | Production process is energy inefficient, costly and reliant on decarbonised electricity grid |

Nuclear | Extremely high power, mature technology, minimal emissions from ship | Emissions still produced by reactor fuel production, creation of nuclear waste, risk of accidents, political/regulatory issues |

Source: Clarkson Research, 2020

The decarbonisation of shipping could be a seminal moment for the global energy transition. The industry’s fuel consumption is estimated to be around 250-300 million tons a year – approximately 4% of the global oil demand8. This means it has the scale to influence and increase confidence among suppliers of future fuels and be a catalyst for the deployment of low carbon fuels for the broader energy transition, unlocking the market for these fuels across a range of industries and other hard-to-abate sectors. The falling costs of zero-carbon energy technologies will make alternative fuels increasingly competitive, and McKinsey estimates that clean fuel technology costs could fall by six times if only 2.5% of the global shipping fleet convert to these fuels.

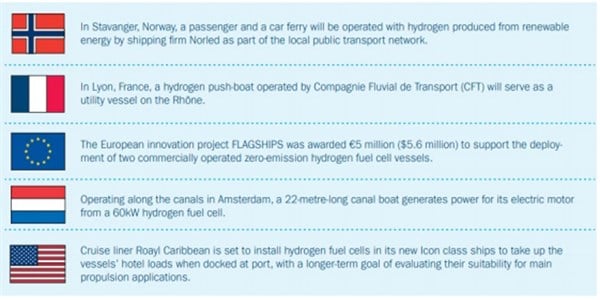

Hydrogen hopes

In the long term, hydrogen fuel cells may be the solution to meeting the IMO’s 2050 targets. The technology is in its infancy but is being tested by a number of companies and government bodies, and green shoots are evident:

Source: Clarkson Research, 2020

So ships running on hydrogen are feasible, but more R&D is required to bring forward the development of prototypes. Oceanwing, the world’s first hydrogen-powered ship, completed its initial voyage between European ports in October 20199. The 35-year-old vessel was converted to produce hydrogen from sea water thanks to an onboard desalination unit and a solar-powered electrolyser. It can store up to 62kg (2MWh) of hydrogen and its owners plan to develop a commercial product for ships by 2025-30.

Cargo ships tend to have a useful economic life of around 20-30 years, so any reduction in emissions will, out of necessity, be gradual given the time it takes to renew the global fleet. In the near term we expect more shipping companies to use liquefied natural gas (LNG) to power their ships. According to the Royal Academy of Engineering, LNG emits about 25% less CO2 and 85% less NOx than low-sulphur fuel, and no sulphur or particulate matter emissions at all.

Operational efficiency

The operating efficiency of ships is an area which, to date, has been underexploited, so there is untapped potential to provide a meaningful reduction in global GHG production. This is also financially additive as fuel savings outweigh the capital expenditure.

Trials are underway to see whether wind-assisted propulsion has a part to play in reducing shipping industry emissions. Aside from the use of spinnakers or kites, one of the most interesting mechanical options is the use of Flettner rotors. These are tall rotating cylinders fitted to ships. Wind travelling round them creates a sideways force that propels a ship forward. Rotors have been fitted to a passenger ferry and tanker in the Maersk Tankers fleet. According to Science magazine such rotors could cut fuel consumption by 10%.

Figure 4: GHG-reducing processes under consideration for Condor Ferries

Process | Estimated reduction in emissions |

|---|---|

Slow steaming and route optimisation | n 12% reduction in at-sea average speed leads to an average decrease of 27% in daily fuel consumption and thus fewer GHG emissions. Cutting speeds by 30% reduces the GDP of exporting countries by less than 0.1%, according to a Delft study |

Voyage optimisation – the prediction of ship performance in various sea states to minimise fuel consumption | 5%-10%(IMO) |

Weather-based route optimisation | Accounts for fuel savings of 3% (IMO) |

Hull design, propeller optimization and waste heat recovery | 2-20% (IMO) |

Ship upgrades include fitting bows with bulbous extensions below the water line to reduce drag, or painting hulls with low-friction coatings | 1-5% (IMO) |

Rotating cylinders: wind travelling round spinning rotors creates a sideways force to propel a ship | Rotors have been fitted to a passenger ferry and to a tanker in Maersk Tankers’ fleet. According to Science magazine these rotors could cut fuel consumption by 10% |

Behavioural science interventions | Used only in aviation so far, but transferrable to shipping. Pilots are sent their fuel savings targets and feedback on their progress through the post to their homes. This proved the most costeffective tactic, “improving fuelling precision, in-flight efficiency measures and efficient taxiing practices by 9% to 20%”. |

Source: IMO, Clarkson Research, University of Chicago and London School of Economics and Political Science, 2020

Conclusion

Attainment of the UN SDGs relies on advances in sustainable maritime transport, which in turn is a driver of wider sustainable development. In accordance with the recommendation made by the UN secretary general’s High-level Advisory Group on Sustainable Transport, all stakeholders must make a genuine commitment to transforming maritime transport, in terms of individual travel and freight, into something that is “safe, affordable, accessible, efficient and resilient while minimising carbon and other emissions and environmental impacts”.

Despite environmental concerns, the shipping industry offers significant social and economic benefits, and we believe is an acceptable investment in an RI strategy. Through ownership of Condor Ferries, we reflect this view in our sustainable infrastructure strategy where we will continue to provide significant social benefit to the Channel Islands. With global trade expected to grow further over the next 30 years, the industry also requires widespread adoption of clean fuel propulsion, and we look forward to helping to progress the agenda for cleaner fuel technology.

Important information: For use by Professional and/or Qualified Investors only (not to be used with or passed on to retail clients).

Past performance is not a guide to future performance. Your capital is at risk. The value of investments and any income is not guaranteed and can go down as well as up and may be affected by exchange rate fluctuations. This means that an investor may not get back the amount invested. This document is not investment, legal, tax, or accounting advice. Investors should consult with their own professional advisors for advice on any investment, legal, tax, or accounting issues relating to an investment with Columbia Threadneedle Investments. The analysis included in this document has been produced by Columbia Threadneedle Investments for its own investment management activities, may have been acted upon prior to publication and is made available here incidentally. Any opinions expressed are made as at the date of publication but are subject to change without notice and should not be seen as investment advice. This document includes forward looking statements, including projections of future economic and financial conditions. None of Columbia Threadneedle Investments, its directors, officers or employees make any representation, warranty, guaranty, or other assurance that any of these forward-looking statements will prove to be accurate. Information obtained from external sources is believed to be reliable, but its accuracy or completeness cannot be guaranteed. In Dubai this document is distributed by Columbia Threadneedle Investments (ME) Limited, which is regulated by the Dubai Financial Services Authority (DFSA). For Distributors: This document is intended to provide distributors with information about Group products and services and is not for further distribution. For Institutional Clients: The information in this document is not intended as financial advice and is only intended for persons with appropriate investment knowledge and who meet the regulatory criteria to be classified as a Professional Client or Market Counterparties and no other Person should act upon it. In Europe issued by Threadneedle Asset Management Limited. Registered in England and Wales, Registered No. 573204, Cannon Place, 78 Cannon Street, London EC4N 6AG, United Kingdom. Authorised and regulated in the UK by the Financial Conduct Authority. Columbia Threadneedle Investments is the global brand name of the Columbia and Threadneedle group of companies.