Cloud computing, machine learning and the potential of the, as yet, relatively untapped field of data science have been rapidly rising up the agenda of the investment world. In an industry that is undergoing seismic changes, the capabilities, reach and efficiencies that data science innovation offers have potential to play an important role.

At a time when demand for ESG integration is growing and confidence in the investment impacts of traditional ESG approaches remains high, data science offers the additional prospect of solving for the effective integration of meaningful non-financial analysis in investment, at scale and with global reach. The vast and growing array of non-financial data, combined with the inputs required for traditional analytics and the importance of timeliness in execution, has seen responsible investment move beyond the point where Excel offers anything other than a superficial solution.

These areas are becoming significant game changers in the industry and will be key focus issues over the course of 2019, particularly for those in the responsible investment industry trying to realise the potential of considering ESG issues in enhancing investment outcomes and performance. The era of forward-looking, evidence-based and actionable analytics is truly on the horizon. This will offer early adopters a real edge in making ESG integration an effective investment reality.

The importance of this is clear. Surveys of asset owners continue to show a clear lack of confidence in the quality of ESG data (and the lack of correlation between old ESG rating frameworks), how it is used or the implications for performance and portfolio risk. Change is overdue. This by itself highlights why data science – the capacity, capability and flexibility it offers, not least for continuous development which is something that has often been absent in traditional IT developments – has become critical to navigating the changes being seen in the industry.

We have been working with clients to show them how evidenced-based, quantitatively-tested advanced analytics work. When clients see how these build on evidence-based models that are built into quantitatively-tested analytical frameworks and disseminated through interactive and purposive data science dashboards, the response has been strongly positive, setting aside the concerns and reservations expressed in asset owner surveys. Seeing actionable signals that produce forward excess return benefits and which are additive to, rather than replacements for, fundamental research and financial analytics has proven persuasive.

Artificial Intelligence and machine learning also offer the prospect of extending ESG analytics into areas that have otherwise proven challenging, such as Emerging Market small cap and high yield.

Growing aspirations in responsible investment

Using capital for purpose – investing for outcome and impact – is another topical issue that has been rising up the agenda. Social, green and sustainable outcomes and impacts are now squarely on the agenda.

This is, once again, an area where much in traditional ESG frameworks falls short, although repackaging ESG as sustainability and outcomes is common. The research and analytical needs in this area require a different focus, one that is clearly on the outputs, products and services of companies and the thematic needs and trends they address, such as those of the UN Sustainable Development Goals.

Despite a relatively quiet third quarter in 2018, the growth and development of ICMA’s green, social and sustainable bond frameworks and related markets has helped open this debate up more widely, which will frame another key theme for 2019.

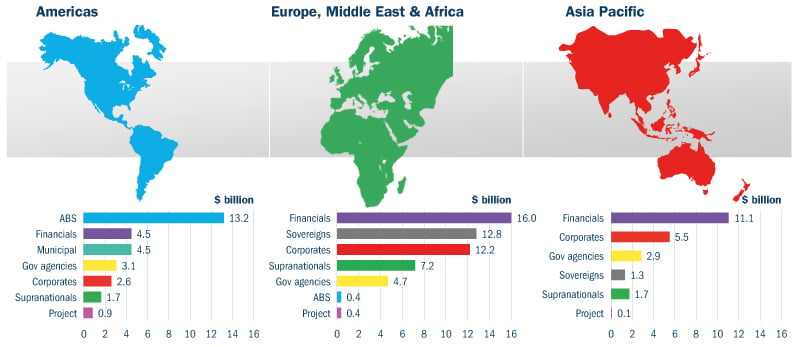

Green Bond Issuance by Region (1Q-3Q 2018)

Source: Bloomberg, NEF.

Climate change

Alongside this focus, 2019 can be expected to see the climate change debate intensify. The recommendations of the Financial Stability Board’s Task Force on Climate-Related Financial Disclosures (TCFD) gather ever more supporters as the TCFD pushes for companies to publish better data about how they manage climate-related risks. Policy and regulatory interventions including Article 173 of the French Energy Transition Law, which came into force in 2016, are continuing to have a significant influence, shaping the work of policymakers beyond France. The focus is moving beyond carbon foot-printing, which has become the staple for assessing climate exposures, in the search for more insightful ways of assessing climate exposures and risk.

Behavioural biases

The examination of human behaviour within investment decision-making has flourished in the last ten years. Now, as a new focus on the investment relevance and potential of ESG integration takes a firmer hold, behavioural disciplines will need to be applied to this field as they have to other aspects of investment. With continuing skepticism around the investment focus and relevance of ESG agendas, the behavioural biases that will play out over the transition to and growing integration of ESG will be important. Looking forward this is another area of development and focus that will be moving up the agenda and playing an important role for us and many others.