The answer is: it really depends. And it depends on the interplay of three forces: what is driving bond yields higher; how policy makers, especially central banks, respond; and if equity cash flows, or earnings, are able to grow at the heady pace they are presently anticipated to.

Breaking down the bond yield

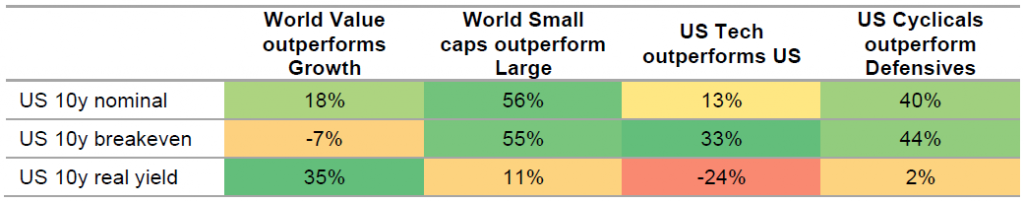

In recent weeks, the order of battle has shifted, with real yields leading the march higher as breakeven moves have stalled. While this suits value stocks, it is more problematic for growth stocks that have been huge beneficiaries of both higher breakevens and lower real yields. Rising breakevens are important for size, cyclicality and the relative performance of tech. Figure 1 captures some of these heuristics.

Real yields can rise for very different reasons

Central banks and cash flows

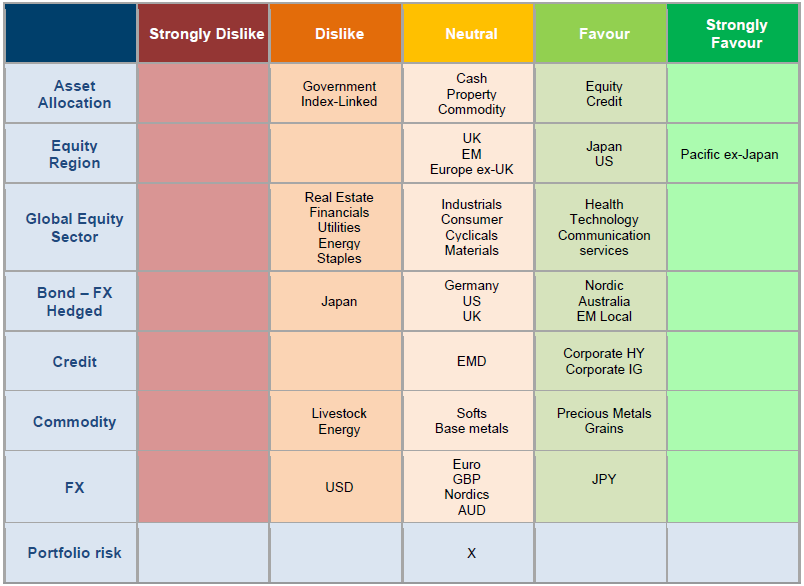

Figure 3: Asset allocation snapshot

Source: Columbia Threadneedle Investments, 1 March 2021